estate tax exemption 2022 proposal

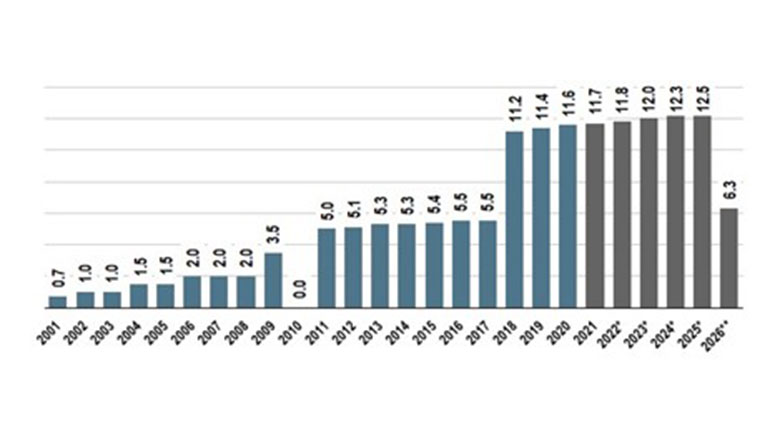

Get information on how the estate tax may apply to your taxable estate at your death. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

Tax Implications Of Biden S Bbb Agenda

Decrease of Valuable Estate and Gift Tax Exemptions Effective January 1 2022 Time is now of the essence for utilizing gift and estate tax exemptions.

. The new exemption amount. The increased exemption was designed to take effect on. The good news is that.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. A provision of the proposed legislation that would become effective Jan. The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022.

If on the other hand a person takes advantage of the current 11700000 unified Gift and Estate exemption in 2021 by giving away that amount in 2021 ex. 11700000 in 2021 and 12060000 in 2022. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

The estate tax exemption is. Increase the top rate to 396 beginning in 2023. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset.

As of January 1 2022 that will be cut in half. Thankfully under the current proposal. Ad From Fisher Investments 40 years managing money and helping thousands of families.

This means if an individual dies in 2022 and his or her lifetime gift and estate assets add up to be greater than 62 million their estate could incur taxes. Under the Plan the current Lifetime Exemption will be reduced to 5000000 per person or 10000000 for married couples and adjusted for inflation to 6000000 per. 12 rows The federal estate tax exemption for 2022 is 1206 million.

Some proposals would have sidelined a number of established estate planning strategies while other proposals could have increased the frequency of use and usefulness of. Proposition 2 increased the homestead exemption for school district property taxes from 25000 to 40000. Estates of decedents survived by a spouse.

November 03 2021. No increase in the estate gift tax rate has been proposed nor has a reduction in the current 117 million allowance been proposed. The effect of the change would be to reduce the basic exclusion amount for estate.

As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US. Estate gift and GST tax exemptions will remain at 117 million with increases allowed for inflation in 2022-2025. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

If Grandma does no gifting in 2021 and dies in 2022 or thereafter when the exemption would be based upon one half of 11700000 5850000 adjusted for inflation to. The tax rate for affected wealth transfers would be 40 according to the provision summary. As of January 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately.

The current federal estate tax exemption amount is 11700000 per person. The Biden administrations proposed 2022 budget and tax proposals are far from final however the proposal should still prompt all clients to review their existing estate plans. Bureau of Labor Statistics Consumer Price Index.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. 1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for. 24 rows On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is.

The top rate would apply. However the 117 million. The package proposed reducing the current 117 million estategift tax exemption by 50 percent on January 1 2022 eliminating the use of valuation discounts for non.

If you have an estate of 10000000. The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend.

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Estate Planning 2022 Federal Tax Update Lathrop Gpm Jdsupra

What The 2021 Tax Proposals Mean The American Families Plan Cpa Practice Advisor

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Proposed Estate Tax Change May Require You Take Action In 2021 Youtube

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Proposed Tax Law Changes Which May Impact You Certilman Balin

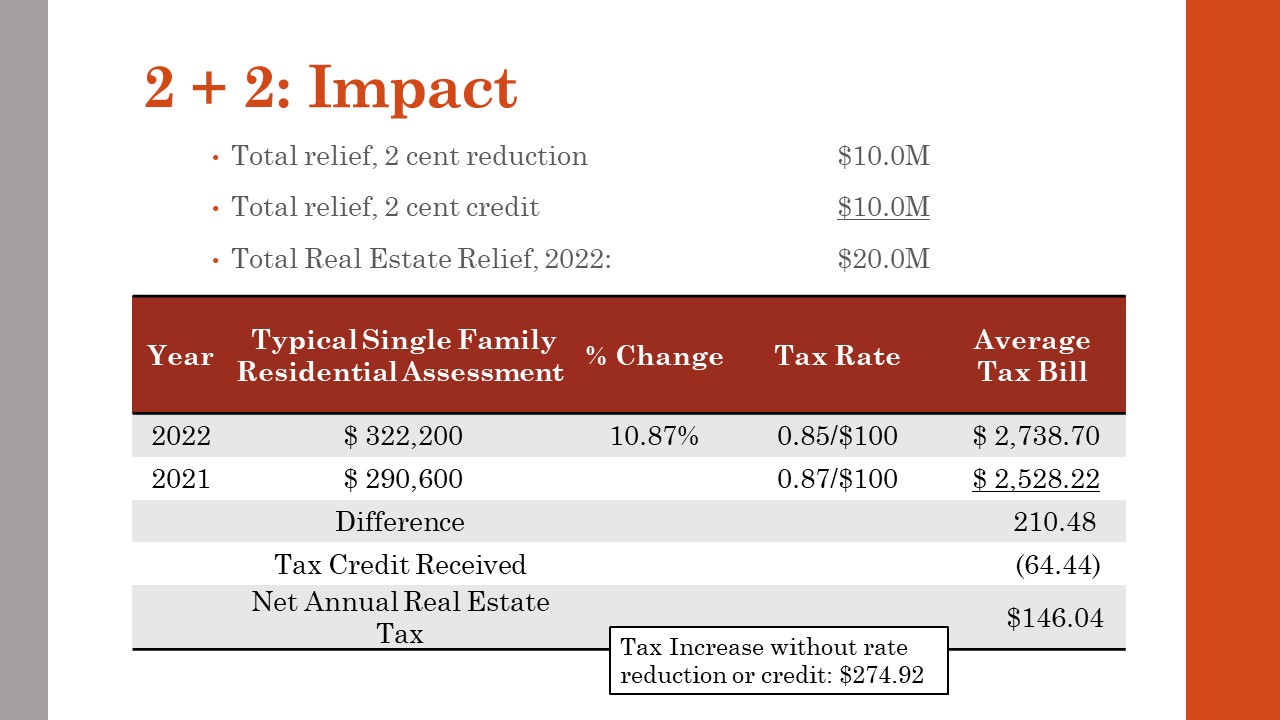

Henrico Approves Ordinance To Offer First Ever Real Estate Tax Credit Henrico County Virginia

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Estate Gift Tax Exemption Could Be Reduced By 50 Percent By 2022 Davis Miles Mcguire Gardner Pllc

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Federal Income Tax Tuition Payment Tax

Photography Vendor Contract How To Draft A Photography Vendor Contract Download This Photography Vendor Cont Contract Template Photography Contract Contract

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh